Closing Costs Deductible Sale . In general, costs that can be considered taxes or interest are. Only a few eligible ones make the cut. not all closing costs are tax deductible. Only a few eligible ones make the cut. you can’t completely deduct all the costs of closing on your house. you can’t completely deduct all the costs of closing on your house. The irs denotes the following as. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. State and local property taxes.

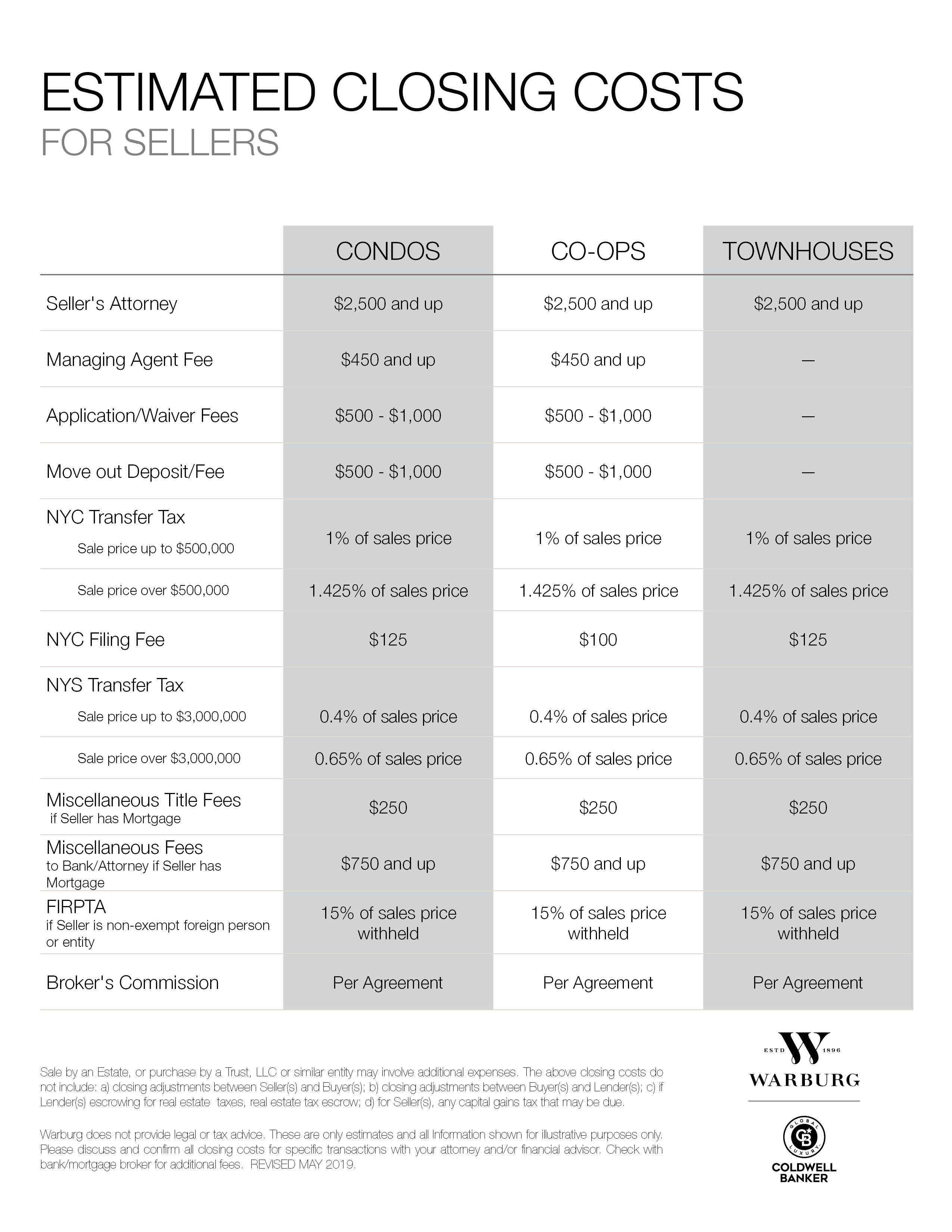

from cbwarburg.com

you can’t completely deduct all the costs of closing on your house. State and local property taxes. you can’t completely deduct all the costs of closing on your house. not all closing costs are tax deductible. The irs denotes the following as. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. In general, costs that can be considered taxes or interest are. Only a few eligible ones make the cut. Only a few eligible ones make the cut.

Estimated Closing Costs Coldwell Banker Warburg Coldwell Banker Warburg

Closing Costs Deductible Sale State and local property taxes. Only a few eligible ones make the cut. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. State and local property taxes. Only a few eligible ones make the cut. The irs denotes the following as. not all closing costs are tax deductible. you can’t completely deduct all the costs of closing on your house. In general, costs that can be considered taxes or interest are. you can’t completely deduct all the costs of closing on your house.

From www.bedelfinancial.com

Closing Costs Infographic Closing Costs Deductible Sale In general, costs that can be considered taxes or interest are. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. you can’t completely deduct all the costs of closing on your house. not all closing costs are tax deductible. The irs denotes the following as. you. Closing Costs Deductible Sale.

From www.thetechedvocate.org

How to calculate closing costs for seller The Tech Edvocate Closing Costs Deductible Sale you can’t completely deduct all the costs of closing on your house. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. In general, costs that can be considered taxes or interest are. not all closing costs are tax deductible. Only a few eligible ones make the cut.. Closing Costs Deductible Sale.

From www.mpamag.com

Closing costs What are they and how are they estimated? Mortgage Closing Costs Deductible Sale The irs denotes the following as. Only a few eligible ones make the cut. State and local property taxes. not all closing costs are tax deductible. you can’t completely deduct all the costs of closing on your house. In general, costs that can be considered taxes or interest are. you are allowed to deduct from the sales. Closing Costs Deductible Sale.

From www.pinterest.com

A Visual Guide to Closing Costs Bay National Title Closing costs Closing Costs Deductible Sale Only a few eligible ones make the cut. State and local property taxes. In general, costs that can be considered taxes or interest are. you can’t completely deduct all the costs of closing on your house. not all closing costs are tax deductible. Only a few eligible ones make the cut. The irs denotes the following as. . Closing Costs Deductible Sale.

From cebwqhst.blob.core.windows.net

Closing Costs Tax Deductible For Seller at Jo Mendes blog Closing Costs Deductible Sale The irs denotes the following as. not all closing costs are tax deductible. Only a few eligible ones make the cut. you can’t completely deduct all the costs of closing on your house. Only a few eligible ones make the cut. you are allowed to deduct from the sales price almost any type of selling expenses, provided. Closing Costs Deductible Sale.

From cebwqhst.blob.core.windows.net

Closing Costs Tax Deductible For Seller at Jo Mendes blog Closing Costs Deductible Sale not all closing costs are tax deductible. State and local property taxes. you can’t completely deduct all the costs of closing on your house. you can’t completely deduct all the costs of closing on your house. The irs denotes the following as. In general, costs that can be considered taxes or interest are. you are allowed. Closing Costs Deductible Sale.

From www.etsy.com

Seller's Net Sheet Seller Proceeds Seller Estimated Closing Costs Closing Costs Deductible Sale In general, costs that can be considered taxes or interest are. Only a few eligible ones make the cut. The irs denotes the following as. Only a few eligible ones make the cut. you can’t completely deduct all the costs of closing on your house. not all closing costs are tax deductible. you can’t completely deduct all. Closing Costs Deductible Sale.

From casaplorer.com

Closing Cost Calculator for Sellers Home Sale Proceeds Closing Costs Deductible Sale The irs denotes the following as. you can’t completely deduct all the costs of closing on your house. State and local property taxes. not all closing costs are tax deductible. In general, costs that can be considered taxes or interest are. Only a few eligible ones make the cut. Only a few eligible ones make the cut. . Closing Costs Deductible Sale.

From cebwqhst.blob.core.windows.net

Closing Costs Tax Deductible For Seller at Jo Mendes blog Closing Costs Deductible Sale Only a few eligible ones make the cut. In general, costs that can be considered taxes or interest are. you can’t completely deduct all the costs of closing on your house. not all closing costs are tax deductible. Only a few eligible ones make the cut. The irs denotes the following as. State and local property taxes. . Closing Costs Deductible Sale.

From www.azibo.com

Closing Costs Calculator Estimating Real Estate Investing Closing Closing Costs Deductible Sale not all closing costs are tax deductible. State and local property taxes. you can’t completely deduct all the costs of closing on your house. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. you can’t completely deduct all the costs of closing on your house. The. Closing Costs Deductible Sale.

From www.sfgate.com

Determining your closing costs as a seller Closing Costs Deductible Sale Only a few eligible ones make the cut. Only a few eligible ones make the cut. The irs denotes the following as. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. not all closing costs are tax deductible. you can’t completely deduct all the costs of closing. Closing Costs Deductible Sale.

From www.bankrate.com

9 Common Closing Costs Explained Closing Costs Deductible Sale you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. In general, costs that can be considered taxes or interest are. you can’t completely deduct all the costs of closing on your house. Only a few eligible ones make the cut. The irs denotes the following as. State and. Closing Costs Deductible Sale.

From casaplorer.com

Closing Cost Calculator for Sellers Home Sale Proceeds Closing Costs Deductible Sale you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. State and local property taxes. In general, costs that can be considered taxes or interest are. The irs denotes the following as. Only a few eligible ones make the cut. not all closing costs are tax deductible. you. Closing Costs Deductible Sale.

From assurancemortgage.com

How to Estimate Closing Costs Assurance Financial Closing Costs Deductible Sale Only a few eligible ones make the cut. not all closing costs are tax deductible. In general, costs that can be considered taxes or interest are. you can’t completely deduct all the costs of closing on your house. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't.. Closing Costs Deductible Sale.

From flipsplit.com

Do TaxDeductible Closing Costs Apply to Rental Sales? FlipSplit Closing Costs Deductible Sale The irs denotes the following as. State and local property taxes. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. In general, costs that can be considered taxes or interest are. Only a few eligible ones make the cut. you can’t completely deduct all the costs of closing. Closing Costs Deductible Sale.

From www.lendingtree.com

Closing Costs that Are (and Aren’t) TaxDeductible LendingTree Closing Costs Deductible Sale In general, costs that can be considered taxes or interest are. Only a few eligible ones make the cut. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. Only a few eligible ones make the cut. you can’t completely deduct all the costs of closing on your house.. Closing Costs Deductible Sale.

From casaplorer.com

Closing Cost Calculator for Buyers (All 50 States) 2023 Casaplorer Closing Costs Deductible Sale Only a few eligible ones make the cut. you can’t completely deduct all the costs of closing on your house. Only a few eligible ones make the cut. In general, costs that can be considered taxes or interest are. you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't.. Closing Costs Deductible Sale.

From learn.roofstock.com

Are closing costs tax deductible on rental property in 2022? Closing Costs Deductible Sale you are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't. you can’t completely deduct all the costs of closing on your house. you can’t completely deduct all the costs of closing on your house. In general, costs that can be considered taxes or interest are. not all. Closing Costs Deductible Sale.